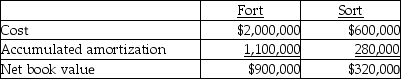

Fort owns 70% of the outstanding common shares of Sort.On December 30,20X3,Sort sold some equipment to Fort for $100,000.The equipment had been purchased by Sort for $120,000 in 20X2,had accumulated amortization of $30,000 and a six-year remaining life at December 31,20X3.Both companies record a full year of amortization expense for assets purchased in the first half of the year and no amortization on assets purchased in the last half of the year.Equipment for Fort and Sort on their separate-entity balance sheets at December 31,20X3 was as follows:

On December 31,20X6,Fort sold the equipment to an outside company for $65,000.What is the gain on sale of equipment to be reported on the consolidated income statement for the year ended December 31,20X6?

Definitions:

Shareholders' Equity

The ownership interest of shareholders in a corporation, represented by their share of the company's assets after all liabilities have been deducted.

Total Assets

The sum of all assets owned by an individual or organization, including both current and fixed assets.

Liabilities

Economic obligations of the company, such as money owed to lenders, suppliers, and employees.

Days Sales Outstanding (DSO)

A financial measure that indicates the average number of days it takes a company to collect payment after a sale has been made.

Q4: Frey Ltd.acquired 70% of Sabo Ltd.several years

Q12: Which of the following statements about income

Q23: For international standards to be applied effectively,a

Q32: In 20X1,a parent company sold a tract

Q41: What does the Public Sector Accounting Board

Q48: most likely market for cosmetic dentistry,which can

Q104: McDonald Sales prepared a bond issue of

Q127: combined American Marketing Association's 2004/2007 definitions of

Q131: Using the present value tables,please compute the

Q180: Figure 1-5 above,letter "D" represents which era