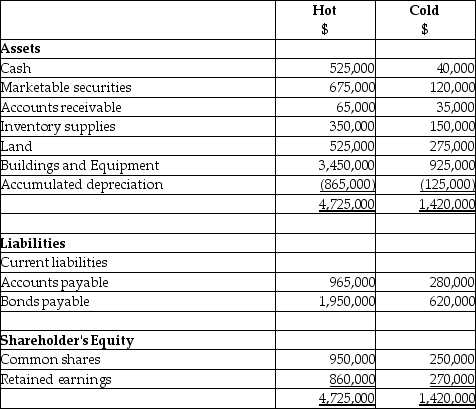

On September 1,20X5,Hot Limited decided to buy 80% of the shares outstanding of Cold Inc.for $850,000.Hot paid for this acquisition by using cash of $500,000 and marketable securities for the remaining amount.The balances showing on the statement of financial position for the two companies at August 31,20X5 are as follows:

After a review of the financial assets and liabilities,Hot determines that some of the assets of Cold have fair values different from their carrying values.These items are listed below:

• Inventory has a fair value of $130,000

• The building has a fair value of $1,090,000.The remaining useful life of the building is 20 years.The accumulated depreciation on the building at the time of acquisition was $50,000.

• A trademark has a fair value of $300,000.The trademark is estimated to have a useful life of 15 years.

• The bonds payable have a fair value of $720,000 and are due in August 31,20X9.

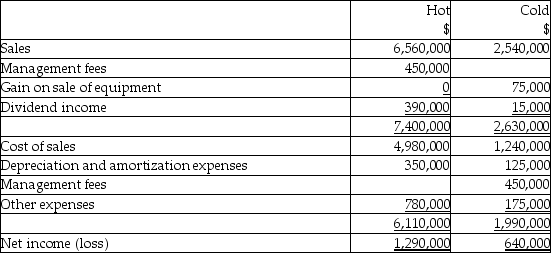

During the 20X9 fiscal year,the following events occurred:

1.Hot sold merchandise to Cold for $200,000.Profit margin on these sales is 30%.Cold still has inventory on hand of $70,000.Included in the opening inventory of Cold for 20X9 is merchandise purchased from Hot in 20X8 for $150,000.The gross profit margin on these sales was 30%

2.Cold sold merchandise to Hot for $500,000.The gross margin on these sales was 40%.At the end of the year,$180,000 of this was still in Hot's inventory.Included in the opening inventory of Hot for 20X9 was merchandise purchased from Hot in 20X8 for $230,000.The profit margin on these sales had been 30%.

3.During 20X9,Cold sold to Hot equipment resulting in a gain to Cold of $75,000.At the time,the original cost and accumulated depreciation to date for the equipment on the Cold's books was: $510,000 and 160,000.The remaining useful life for this equipment is 15 years.Depreciation is fully recorded in the year of purchase and no depreciation is recorded in the year of disposal by both companies.

4.During 20X9,Cold paid management fees of $450,000 to Hot.

5.During 20X9,Cold paid dividends of $400,000 and Hot paid dividends of $600,000

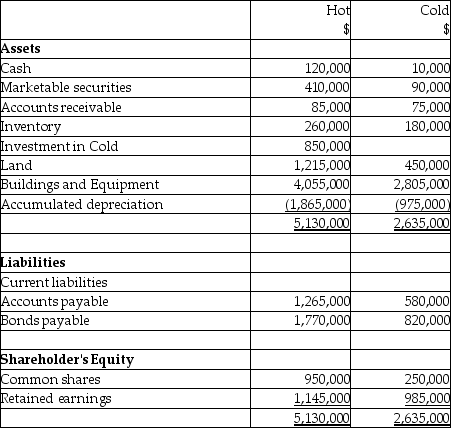

Statements of Financial Position

As at August 31,20X9

Statements of Comprehensive Income

For the year ended August 31,20X9

Required:

Prepare the consolidated statement of financial position for Hot as at August 31,20X9.Calculate the closing balance for the retained earnings and the non-controlling interest.The company used the parent-company extension method to determine goodwill for this acquisition.

Definitions:

Lean Against The Wind

Lean against the wind is a policy approach where monetary or fiscal policies are used counter-cyclically to stabilize the economy, reducing excessive growth in booms and supporting growth in recessions.

Stabilization Policy

Economic strategies and actions taken by governments or central banks to stabilize an economy, aiming to reduce fluctuations in the business cycle and ensure steady growth.

Weather The Storm

A metaphor describing the ability to endure or survive through difficult or challenging times.

Time Inconsistent

When preferences change over time in such a way that what is preferred at one point in time is inconsistent with what is preferred at another time.

Q3: Gumble Ltd.has owned 65% of the common

Q4: In 20X5,Bing created a wholly owned subsidiary

Q7: Under the temporal method,which of the following

Q9: XY Co.is a Canadian company listed on

Q10: How should accounting fees for an acquisition

Q31: Bowen Limited purchased 60% of Sloch Co.when

Q32: During the first quarter of the company's

Q88: On January 1,2013,Davie Services issued $20,000

Q128: the movie Tin Men,two rival salesmen engaged

Q202: people would assume that in marketing the