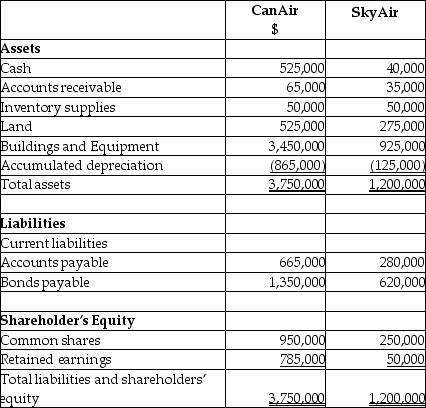

On September 1,20X5,CanAir Limited decided to buy 100% of the shares outstanding of SkyAir Inc.for $900,000.Can Air will pay for this acquisition by using cash of $500,000 and issuing share capital for the remaining amount.The balances showing on the statement of financial position for the two companies at August 31,20X5 are as follows:

After a review of the financial assets and liabilities,CanAir determines that some of the assets of SkyAir have fair values different from their carrying values.These items are listed below:

• Land has a fair value of 225,000

• The building has a fair value of 1,090,000.The remaining useful life of the building is 20 years.

• Internet domain name has a fair value is $55,000.The domain name is estimated to have a useful life of 5 years.

• Customer lists has a fair value is $35,000.It is estimated that the customer lists will have a useful life of 7 years.

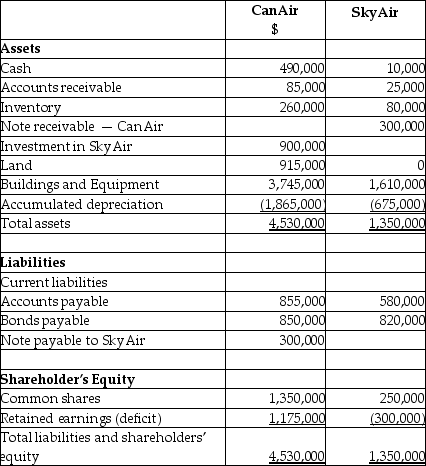

During the 20X9 fiscal year,the following events occurred:

1.On March 1,20X9,SkyAir sold land to CanAir for $390,000,which had a carrying value of $275,000.Can Air paid for this with $90,000 cash and a note payable for the difference.This note pays interest at 10% which is paid monthly.

2.CanAir provided management expertise to SkyAir and charged management fees of $890,000.

3.CanAir sold supplies (included in CanAir sales)to SkyAir for $200,000.CanAir charged SkyAir an amount that was 25% above costs.SkyAir still has supplies on hand of $70,000.

4.In 20X8,SkyAir had provided seat space on flights to Can Air for a value of $500,000.This amount was included in sales for SkyAir.Profit margin on these sales is 40%.At the end of August,20X8,CanAir still had an amount of $200,000 in these prepaid seats that had not yet been used.(CanAir includes this in inventory. )

Statements of Financial Position

As at August 31,20X9

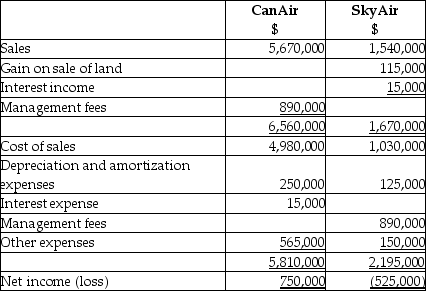

Statements of Comprehensive Income

For the year ended August 31,20X9

Required:

Calculate the consolidated retained earnings as at August 31,20X9.

Prepare the consolidated Statement of Financial Position for the year ended August 31,20X9.

Definitions:

Weighted Average Cost

A method of valuing inventory and cost of goods sold that considers the cost of each item in proportion to its quantity.

Perpetual Inventory

Perpetual inventory is a system that continuously updates inventory records to reflect sales, purchases, and inventory levels in real-time.

Inventory Turnover

A metric indicating the frequency at which a company's stock is sold and replenished within a given timeframe.

Sales In Inventory

The quantity of goods that are available for sale in a company's inventory.

Q1: Pooke Co.acquired 75% of Finch Ltd.3 years

Q3: Under the temporal method,which of the following

Q4: Compare and contrast the goodwill impairment test

Q5: Which of the following is a non-financial

Q7: On July 1,2013,Avery Services issued a 4%

Q7: On September 1,20X5,High Limited decided to buy

Q31: Discount on bonds payable is considered to

Q60: Carter Company records sales on account of

Q102: On November 1,2015,Archangel Services issued $200,000 of

Q150: Marriott,Lands' End,and Home Depot deliver customer value