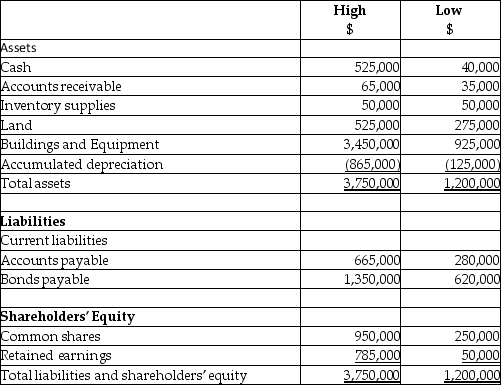

On September 1,20X5,High Limited decided to buy 70% of the shares outstanding of Low Inc.for $630,000.High will pay for this acquisition by using cash of $500,000 and issuing share capital for the remaining amount.The balances showing on the statement of financial position for the two companies at August 31,20X5 are as follows:

After a review of the financial assets and liabilities,High determines that some of the assets of Low have fair values different from their carrying values.These items are listed below:

• Land has a fair value of 225,000

• The building has a fair value of 1,090,000.The remaining useful life of the building is 20 years.

• Patent is $100,000.The patent is estimated to have a useful life of 5 years.

During the 20X7 fiscal year,the following events occurred:

1.On March 1,20X7,Low sold land to High for $390,000,which had a carrying value of $275,000.High paid for this with $90,000 cash and a note payable for the difference.This note pays interest at 10% which is paid monthly.

2.High sold supplies (included in High sales)to Low for $200,000.Profit margin on these sales is 25%.Low still has supplies on hand of $70,000.

3.In 20X6,Low had provided seat space on flights to High for a value of $500,000.This amount was included in sales for Low.Profit margin on these sales is 40%.At the end of August,20X6,High still had an amount of $200,000 in these prepaid seats that had not yet been used.(High includes this in inventory. )

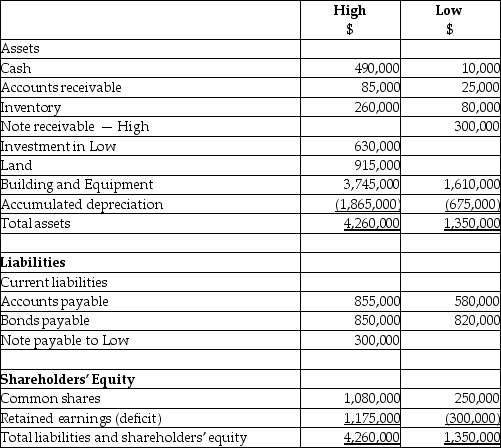

Statements of Financial Position

As at August 31,20X7

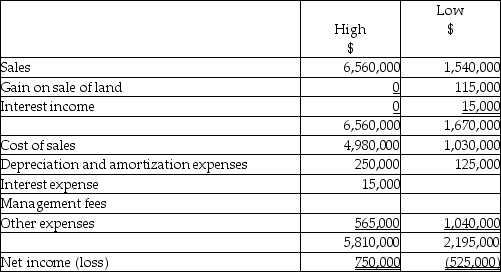

Statements of Comprehensive Income

For the year ended August 31,20X7

Required:

Calculate the balances for the following consolidated balances of High at August 31,20X7 assuming High uses the parent-company extension method approach:

a.Goodwill

b.Retained Earnings

c.Patent,net

Definitions:

Resource Market

A market where resources (like labor, capital, and land) are bought and sold, allowing businesses to acquire what they need to produce goods and services.

Resource Market

A market where resources (or inputs) for production, such as labor, land, and capital, are bought and sold.

Financial Capital

Financial capital comprises the funds necessary for businesses to buy what they need to produce their products or to provide their services, including money, credit, and other financial instruments.

Financial Responsibility

The obligation to manage one's resources prudently and ensure that all financial obligations are met.

Q4: On November 2,20X9,Henry Company purchased a machine

Q4: On December 31,20X5,Space Co.purchased 100% of the

Q5: Liverpool Company operates retail stores in Canada

Q5: On December 1,20X5,Gillard Ltd.sold goods to International

Q25: of the following are examples of products

Q34: On whose books are the consolidating adjusting

Q104: McDonald Sales prepared a bond issue of

Q115: local university offers business courses for a

Q155: On July 1,2013,Avery Services issued a

Q159: benefits or customer value received by users