Sugar Corp and Syrup Limited have reached an agreement in principle to combine their operations as of October 1,20X9.However,the Board of directors cannot decide on the best way to accomplish the combination.Below are the alternatives being considered:

1.Sugar acquires the net assets of Syrup for $1,700,000 cash.

2.Sugar acquires only the assets for $2,650,000 cash.

3.Sugar acquires all of the outstanding shares of Syrup by issuing shares with a fair market value of $1,700,000.

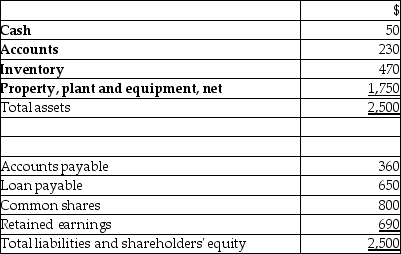

Syrup has the following assets and liabilities at October 1,20X9,(in thousands of dollars)

The only item that has a fair value different from its carrying value is the property,plant and equipment,which has a fair value of $1,900.

Required:

Explain how each transaction is different from the acquirer's point of view.Prepare the journal entry that would be recorded by Sugar for each these alternatives.

Definitions:

Therapeutic Back Massage

A specialized form of massage aimed at alleviating back pain, promoting relaxation, and improving overall well-being through various techniques.

Acetaminophen

A medication used to relieve pain and reduce fever, commonly available over-the-counter.

Pain Indicator

A sign or symptom that suggests the presence of pain or discomfort in a person.

Self-report

A method of gathering information where individuals provide data about themselves, often used in surveys, questionnaires, and research studies.

Q2: Which of the following financial statements would

Q7: Who is the largest issuer of debt?<br>A)Banks<br>B)Government<br>C)Publicly-accountable

Q8: One of the objectives of government is

Q22: Which consolidation method includes only the parent's

Q22: What does the net debt indicate on

Q32: Which of the following is not a

Q72: On May 1,2013,Metro Company has bonds with

Q121: 1952,General Electric's annual report stated,"The concept introduces…marketing…at

Q178: Shortly after World War II,Sam Jackson developed

Q236: United Way of Greater Toronto (UWGT),like many