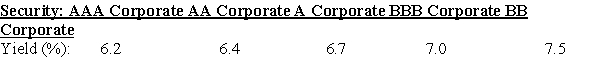

Consolidated Insurance wants to raise $35 million in order to build a new headquarters.The company will fund this by issuing 10-year bonds with a face value of $1,000 and a coupon rating of 6.5%,paid semiannually.The above table shows the yield to maturity for similar 10-year corporate bonds of different ratings.Which of the following is closest to how many more bonds Consolidated Insurance would have to sell to raise this money if their bonds received an A rating rather than an AA rating?

Definitions:

Horizontal Analysis

A financial analysis technique that examines the changes in the amounts of specific financial statement items over a period of time.

Base Year Figure

A reference point in time used for comparison in financial and economic analysis to track changes and trends.

Common-sized Income Statement

An income statement in which each line item is expressed as a percentage of sales revenue, facilitating comparison across periods and companies.

Common-sized Balance Sheet

A financial statement in which each line item is expressed as a percentage of total assets, facilitating comparison across firms and time periods.

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1622/.jpg" alt=" General Industries is

Q25: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1622/.jpg" alt=" Above are portions

Q26: Why must care be taken when comparing

Q36: Suppose the quarterly arithmetic average return for

Q39: If you want to value a firm

Q42: Gonzales Corporation generated free cash flow of

Q73: When looking at investment portfolios historically,was there

Q84: Manufacturer A has a profit margin of

Q91: Which of the following is the LEAST

Q93: The profitability index for project A is