Use the table for the question(s) below.

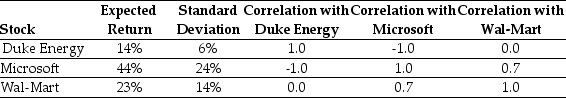

Consider the following expected returns, volatilities, and correlations:

-Which of the following combinations of two stocks would give you the biggest reduction in risk?

Definitions:

Family Life

The routine interactions, activities, and relationships among members of a household, including parents, children, and extended relatives.

Labor Force

Consists of all the working-age individuals who are employed or actively seeking employment within an economy.

Occupational Segregation

A pattern in which different groups of workers are separated into different occupations.

Secretaries

Administrative professionals responsible for managing correspondence, maintaining files, and executing other office tasks to support an organization or individual.

Q4: The risk premium of a security is

Q7: Which of the following combinations of two

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1622/.jpg" alt=" General Industries is

Q20: In general,issuing equity may not dilute the

Q30: You observe the following scatterplot of Ford's

Q42: Which of the following is an advantage

Q61: IBM expects to pay a dividend of

Q84: What is the excess return for Treasury

Q98: Luther Industries has outstanding tax loss carryforwards

Q106: A stationery company plans to launch a