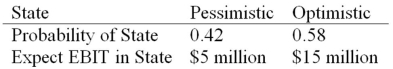

HiLo,Inc.,doesn't face any taxes and has $100 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities shown as follows:

The firm is considering switching to a 40 percent debt capital structure,and has determined that they would have to pay a 10 percent yield on perpetual debt.What will be the level of expected EPS if they switch to the proposed capital structure?

Definitions:

Hepatic Vein

Vein that drains the liver into the inferior vena cava.

Right Atrium

The right atrium is one of the four chambers of the heart, receiving deoxygenated blood from the body and passing it to the right ventricle.

Force Exerted

The physical pressure or effort applied to something.

Precapillary Sphincters

Circular muscles located at the entrance of capillaries that regulate blood flow into the capillary beds.

Q16: Which of the following is an example

Q30: Triangular Arbitrage The U.S.dollar spot exchange rate

Q34: You have been asked by the president

Q43: Calculating Costs of Issuing Stock Plains Corp.recently

Q51: Which of these is the process of

Q57: Daddi Mac,Inc.,doesn't face any taxes and has

Q77: Rose Axels faces a smooth annual demand

Q96: KADS,Inc.,has spent $400,000 on research to develop

Q103: The spot rate between the U.S.dollar and

Q122: Suppose you sell a fixed asset for