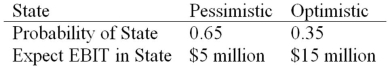

HiLo,Inc.,faces a 38 percent tax rate and has $100 million in assets,currently financed entirely with equity.Equity is worth $50 per share,and book value of equity is equal to market value of equity.Also,let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year,with the possible values of EBIT and their associated probabilities as shown below:

The firm is considering switching to a 40 percent debt capital structure,and has determined that they would have to pay a 10 percent yield on perpetual debt.What will be the level of expected EPS if they switch to the proposed capital structure?

Definitions:

Prolonged Period

An extended duration of time, often longer than expected or usual.

Symbolic Benefits

The intangible advantages that consumers perceive from purchasing and using a product, which relate to their needs for self-expression and social recognition.

Self-Expressive

Refers to the ability or qualities of something, typically products or digital platforms, that allow individuals to express their identity and personal values.

Affinities

The natural liking, similarities, or connections between people or things that draw them together or make them compatible.

Q12: Suppose a firm has a dividend payout

Q29: Contrast best efforts underwriting and firm commitment

Q41: You are evaluating two different machines.Machine A

Q46: HiHo Inc.is evaluating a merger with the

Q46: Suppose your firm is considering investing in

Q51: Which of the following statements is correct?<br>A)The

Q58: No Nuns Cos.has a 20 percent tax

Q88: Suppose your firm is considering two mutually

Q105: A graph of a project's _ is

Q107: Which of the following terms is defined