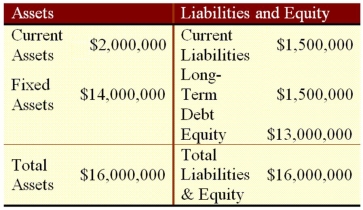

Suppose that Gyp Sum Industries currently has the balance sheet shown as follows,and that sales for the year just ended were $20 million.The firm also has a profit margin of 22 percent,a retention ratio of 42 percent,and expects sales of $30 million next year.If all assets and current liabilities are expected to grow with sales,how much additional funds will Gyp Sum need from external sources to fund the expected growth?

Definitions:

Company Growth

An increase in a company's capacity to produce goods or services, often measured by higher sales, expansion, or larger market share.

Production Facilities

Physical locations such as factories or workshops where goods are manufactured or assembled, equipped with necessary machinery and tools.

Master Sales Representative

A highly skilled and experienced salesperson recognized for achieving excellent sales results and providing outstanding customer service.

Sales Success

The achievement of sales goals or objectives, often measured by the volume of sales, revenue generated, or market share gained.

Q5: Suppose you sell a fixed asset for

Q11: Suppose your firm is considering two mutually

Q13: All of the following will result in

Q19: Your company faces a 34 percent tax

Q35: A project's IRR:<br>A)is the average rate of

Q37: Which of the following will increase the

Q67: Explain patterns of increased capital involvement firms

Q82: TJ Industries has 7 million shares of

Q101: Which of the following describes the type

Q117: Suppose your firm is considering two mutually