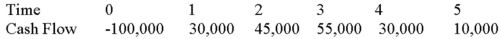

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.

Use the IRR decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Revoke Acceptance

The right of a party to reject goods or services previously accepted, typically due to the discovery of defects or the nonconformity of the goods or services with contractual terms.

Nonconforming Goods

Products that fail to meet the quality, design specifications, or performance standards as outlined in a purchase contract.

Difficulty of Discovering

Refers to the challenges inherent in uncovering or identifying certain facts or truths, often used in legal contexts regarding the complexity of uncovering evidence.

Acceptance of Goods

The act by which a buyer indicates their agreement that the goods received from the seller conform to the contract specifications.

Q30: Explain the security market line's equation.

Q31: Safety stock is referred to as the:<br>A)excess

Q45: Suppose that Papa Bell Inc.'s equity is

Q62: Explain how the firm apportions risk and

Q68: Your company doesn't face any taxes and

Q106: Suppose your firm is considering two mutually

Q107: Use NPV profiles to reconcile sources of

Q109: Expected Return A company's current stock price

Q111: A situation that arises when a firm's

Q116: What is the theoretical minimum for the