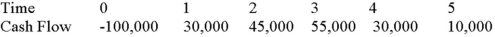

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.

Use the NPV decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Angiography

A medical imaging technique used to visualize the inside of blood vessels and organs of the body, specifically arteries, veins, and the heart chambers.

Blood Urea Nitrogen

A medical test that measures the amount of nitrogen in the blood that comes from the waste product urea, used to assess kidney function.

Creatinine

A waste product produced by muscles from the breakdown of a compound called creatine, commonly measured in blood or urine tests as a marker of kidney function.

Intravenous Moderate Sedation

A controlled administration of drugs through the vein to reduce patient awareness and discomfort during medical procedures.

Q17: Compute the expected return and standard deviation

Q42: Which of the following statements is correct

Q49: Stock A has a required return of

Q61: Suppose that the 2013 actual and 2014

Q65: ADK Industries common shares sell for $40

Q70: Which of the following are the stocks

Q88: Stock Market Bubble If the Japanese stock

Q99: Differentiate among sources of capital funding for

Q102: Compute the IRR statistic for Project X

Q102: We commonly measure the risk-return relationship using