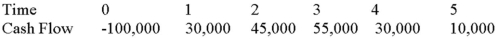

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.

Use the PI decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Strategic Sourcing Process

A methodical approach by organizations to plan for and acquire necessary supplies and services in an effective and efficient manner.

Continuous Savings

The ongoing process of reducing costs or expenses without compromising quality or performance, often through efficiency improvements.

Financial Stability

The condition of having strong financial health and resilience, often characterized by sufficient liquidity, capital, and risk management capabilities.

Developing Close Relationships

The process of building strong, beneficial partnerships based on trust, commitment, and communication, often in a professional or business context.

Q10: HiLo,Inc.,doesn't face any taxes and has $100

Q33: HiLo,Inc.,doesn't face any taxes and has $100

Q37: Why would a firm ever use short-term

Q39: A firm has 5,000,000 shares of common

Q54: Suppose that Papa Bell Inc.'s equity is

Q87: Which of the following current asset financing

Q93: Why,in finance,do we refer to using debt

Q97: Joe's Burgers would like to maintain their

Q100: The Jobs and Growth Tax Relief Reconciliation

Q124: With regard to depreciation,the time value of