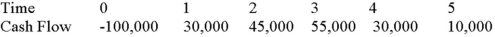

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.

Use the NPV decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Eliminated

Removed or taken away, typically referring to the action of completely doing away with something.

Economic Losses

Financial losses incurred by businesses or individuals, often resulting from poor decisions or market conditions.

Supply Curve

A graphic representation showing the relationship between the price of a good or service and the quantity supplied for a given period.

Exit the Industry

The process by which a business ceases operations in a particular market or industry, usually due to economic pressures or lack of profitability.

Q2: Your company has a 38 percent tax

Q6: Which of the following is one of

Q9: Which of the following is the average

Q11: Suppose a firm pays total dividends of

Q27: You are considering the purchase of one

Q28: You are evaluating two different machines.Machine A

Q32: The optimal cash replenishment level will decrease

Q45: Choosing the optimal level of investment in

Q55: Which of the following statements is correct?<br>A)If

Q89: You are evaluating a product for your