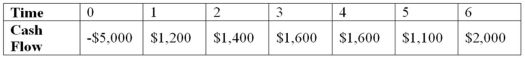

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the MIRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Profit Margin

A financial metric used to evaluate a company's profitability by comparing net income to revenue.

Merchandising Company

A business that purchases goods at wholesale and sells them at retail prices, typically consisting of activities involving buying and selling without significant alteration of the goods.

Periodic Inventory System

An inventory management method where the inventory count is conducted at specific intervals to determine the cost of goods sold.

Statement Of Income

A financial document that reports a company's financial performance over a specific period, detailing revenues, expenses, and net income.

Q4: Which of the following will decrease the

Q11: Suppose that Dunn Industries has annual sales

Q12: Which of the following is the IRS

Q41: Rose has preferred stock selling for 99

Q61: Which of these statements is true?<br>A)When people

Q74: If the firm wants to identify the

Q79: In 2000,the S&P 500 Index earned 11

Q95: Expected Return A company's current stock price

Q101: A financial asset will pay you $10,000

Q125: Which of following is a situation in