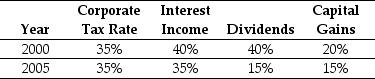

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2000,assuming an average dividend payout ratio of 50%,the effective tax advantage for debt (t*) was closest to:

Definitions:

Personal Care Products

Various consumer items intended for personal hygiene, grooming, or beautification.

Idea Quotas

Pre-determined objectives that specify a certain number of ideas a person must generate within a given time frame.

Product Innovations

The introduction of new or significantly improved goods or services that provide novel benefits or additional value to consumers.

Senior Management

Refers to the highest level of managers within an organization who are responsible for setting strategic goals and making key decisions.

Q7: The change in Luther's quick ratio from

Q11: The alpha for the fad follower's portfolio

Q27: Which of the following statements regarding portfolio

Q34: Assume the following tax schedule:<br>Personal Tax Rates<br>

Q49: The amount of net working capital for

Q61: Suppose Novak Company experienced a reduction in

Q65: In 2005, the effective tax rate for

Q66: The value of Iota if they do

Q88: The value of KD's unlevered equity is

Q100: The expected return for Wyatt Oil is