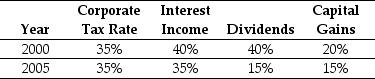

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2005,assuming an average dividend payout ratio of 50%,the effective tax advantage for debt (τ*) was closest to:

Definitions:

Power

The probability that a statistical test will correctly reject a false null hypothesis, effectively detecting an actual effect.

Type II Error

The mistake of failing to reject a false null hypothesis, also known as a "false negative" finding.

Dependent-Samples T-Test

A statistical test used to compare the means of two related groups, indicating if any difference between them is statistically significant.

Confidence Interval

The best estimate of the range of a population value given the sample value.

Q5: If Ideko's future expected growth rate is

Q26: Which of the following statements is FALSE?<br>A)

Q32: Consider the following equation: E + D

Q40: The effective dividend tax rate for a

Q44: Suppose that to raise the funds for

Q63: Which of the following statements is FALSE?<br>A)

Q91: Which of the following influences a firm's

Q110: Assuming that the risk-free rate is 4%

Q119: Which of the following statements is FALSE?<br>A)

Q127: Which of the following statements is FALSE?<br>A)