Use the table for the question(s) below.

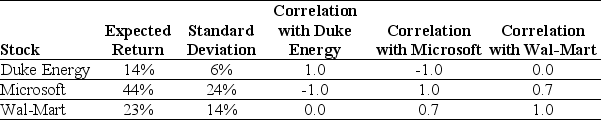

Consider the following expected returns, volatilities, and correlations:

-The expected return of a portfolio that is consists of a long position of $10000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

Definitions:

Firing

Firing, in the context of neural activity, refers to the action of neurons when they send an electrical impulse along their axons, a fundamental process for brain communication.

Endorphins

Endorphins are natural pain-relieving chemicals released by the brain during exercise, excitement, pain, and sexual activity, contributing to a sense of well-being.

Inhibition

A psychological process that involves restraining or suppressing impulses, emotions, or behaviors.

Regulation

The process of controlling or governing according to a system of rules or guidelines to achieve desired outcomes.

Q4: Directors who are not employees, former employees,

Q14: Which of the following statements is FALSE?<br>A)

Q20: Assume that in the event of default,

Q21: The largest stock market in the world

Q29: The NPV of this project in Euros

Q56: Which of the following statements is FALSE?<br>A)

Q65: Assume that you purchased General Electric Company

Q65: In 2005, the effective tax rate for

Q87: If Rockwood finances their expansion by issuing

Q109: Which of the following is NOT an