Use the table for the question(s) below.

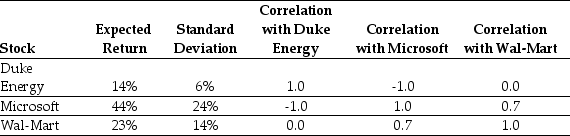

Consider the following expected returns,volatilities,and correlations:

-Consider a portfolio consisting of only Duke Energy and Microsoft.The percentage of your investment (portfolio weight) that you would place in Duke Energy stock to achieve a risk-free investment would be closest to:

Definitions:

Dividends Paid

The total amount of dividends that a company has returned to its shareholders from its net income.

Voting Shares

Equity securities granting holders the prerogative to vote on corporate decisions and board member selections.

Dividends Paid

The portion of a company's earnings that is distributed to shareholders as a return on their investment in the company's equity.

Voting Shares

Voting shares that enable the owner to have a say in corporate affairs, such as the selection of the board of directors.

Q2: The beta for the risk free investment

Q7: Which of the following statements is FALSE?<br>A)To

Q9: If you want to value a firm

Q11: Which of the following is NOT a

Q36: The expected alpha for Wyatt Oil is

Q39: The NPV for Epiphany's Project is closest

Q43: If the risk-free rate is 3% and

Q44: Suppose that to raise the funds for

Q51: Using the average historical excess returns for

Q79: Calculate the total Free Cash Flows for