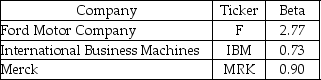

Use the following information to answer the question(s) below.

-If the market risk premium is 6% and the risk-free rate is 4%,then the expected return of investing in Merck is closest to:

Definitions:

Self-Assessment

The process of evaluating one’s own performance, strengths, and weaknesses.

Job Hunt

The process of actively seeking employment opportunities.

Annual Report

An official document issued by a company or organization, summarizing its operations, financial performance, and future outlook over the past year.

Company

An organization engaged in commercial, industrial, or professional activities, often constituted legally as a unit.

Q2: Suppose that you have invested $30,000 invested

Q16: Consider the following timeline detailing a stream

Q16: The payback period for project Alpha is

Q26: The depreciation tax shield for Shepard Industries

Q27: If a firm's excess cash holdings are

Q34: Consider a portfolio consisting of only Microsoft

Q69: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2790/.jpg" alt="The term

Q70: When all investors correctly interpret and use

Q85: Using just the return data for 2008,

Q99: What is the variance on a portfolio