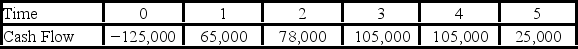

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 12 percent,and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years,respectively.  Use the MIRR decision rule to evaluate this project; should it be accepted or rejected?

Use the MIRR decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Open-Book

A management approach where employees are given access to company financial information to encourage understanding of business operations and promote informed decision making.

Profits

The financial gain obtained when the revenues generated from business activities exceed the expenses, costs, and taxes needed to sustain the activity.

Decision Problem

A situation that requires a choice to be made among different alternatives.

Leader

An individual who guides or directs a group towards achieving a common goal by influencing or motivating their behavior.

Q29: The atomic mass number of a nucleus

Q34: Which of the following will directly impact

Q54: The quantum mechanical model of the hydrogen

Q59: Which of the following resemble checks,but differ

Q60: Suppose that Dunn Industries has annual sales

Q76: Suppose your firm is considering investing in

Q83: The alpha emission process results in the

Q88: Which of the following statements is correct?<br>A)

Q89: Which of the following current asset financing

Q114: Which of these makes this a true