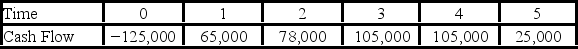

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 12 percent,and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years,respectively.  Use the discounted payback decision rule to evaluate this project; should it be accepted or rejected?

Use the discounted payback decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Ocean Zones

The division of the ocean into different layers or regions, typically based on depth, light penetration, distance from the shoreline, and ecological characteristics.

Variable Conditions

Situations or environmental factors that can change or vary, affecting outcomes in experiments or processes.

Biota

The total collection of organisms in a given area or at a given time.

Emergent

A phenomenon or property that arises from the complex interactions of simpler elements, not predictable from the characteristics of the individual elements alone.

Q5: If demand for a firm's products suddenly

Q6: Suppose your firm is considering investing in

Q13: Which of these completes this statement to

Q15: Compute the expected return given these three

Q24: A company has a beta of 2.91.If

Q29: Your firm needs a machine which costs

Q54: You have a portfolio consisting of 20

Q60: Which of the following is not a

Q65: Determine which one of these three portfolios

Q68: PNB Cos.has sales of $250,000 and cost