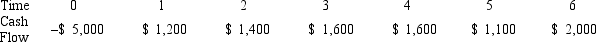

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the MIRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Bearing Mandrel

A tool or device used to support, guide, or hold a bearing in place during installation or maintenance procedures.

Metric Micrometer

A precision measuring instrument that uses a calibrated screw widely used for precise measurement of small distances in the metric system.

Thimble

A small metal or plastic cap with a grooved edge used to protect the finger while pushing a needle through fabric in sewing; or, a fitting used in rope systems to protect the loop from wear.

Torquing

The process of applying a specific amount of twist or force to fasteners, such as bolts and nuts, to ensure they are properly secured.

Q16: You are evaluating a project for The

Q21: What is the energy needed to change

Q36: Which of the following transitions in hydrogen

Q42: Suppose your firm is considering investing in

Q54: Which of the following statements is correct?<br>A)

Q62: A ruby laser can deliver a 4.33-J

Q85: What energy must be added or given

Q100: KADS,Inc.,has spent $400,000 on research to develop

Q102: Suppose your firm is considering two mutually

Q110: You own $2,000 of City Steel stock