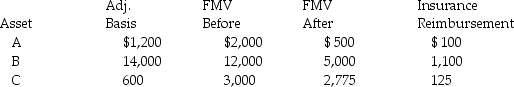

Determine the net deductible casualty loss on the Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2013 and the following occurred:

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

All casualty losses were nonbusiness personal use property losses and none occurred in a federally declared disaster area.

What is the amount of the net deductible casualty loss?

Definitions:

Breakeven Point

The point at which total cost and total revenue are equal, meaning there is no net loss or gain.

Average Variable Costs

The total variable costs (costs that change with the level of output) divided by the number of units produced, indicating the average cost of producing each unit.

Industry Giants

The largest and most influential companies within a sector, known for their market domination, innovation, and financial capabilities.

Lower Prices

Lower prices indicate a decrease in the cost that consumers are asked to pay for goods or services, often aimed at boosting sales or competitiveness.

Q2: In 2006,Gita contributed property with a basis

Q3: Vector Inc.'s office building burns down on

Q31: Adam owns interests in partnerships A and

Q34: Ron's building,which was used in his business,was

Q51: Joseph has AGI of $170,000 before considering

Q69: Chad and Jaqueline are married and have

Q87: Laura,the controlling shareholder and an employee of

Q90: On July 25 of this year,Raj sold

Q93: Xerxes Manufacturing,in its first year of operations,produces

Q95: Ron obtained a new job and moved