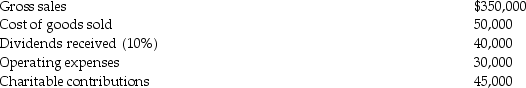

Jackel,Inc.has the following information for the current tax year:

What is Jackel's charitable contribution deduction? What is Jackel's taxable income?

What is Jackel's charitable contribution deduction? What is Jackel's taxable income?

Definitions:

Face Validity

The extent to which a test is subjectively viewed as covering the concept it purports to measure, often assessed through its appearance to non-experts.

Predictive Validity

The extent to which a score on a test or measurement accurately predicts future performance on a related task or behavior.

Concurrent Validity

The degree to which the results of a particular test or measurement correspond to those of a previously established measurement for the same construct.

Content Validity

The extent to which a test measures all aspects of the concept or construct it intends to assess, ensuring that the test is fully representative.

Q11: All of the following items are included

Q36: Ellen is a single taxpayer with qualified

Q42: On June 1,2014,Ellen turned 65.Ellen has been

Q42: A nursing home maintains a cafeteria that

Q64: Under the cash method of accounting,income is

Q75: Jackel,Inc.has the following information for the current

Q103: The only business entity that pays income

Q103: Identify which of the following statements is

Q105: Current E&P does not include<br>A)tax-exempt interest income.<br>B)life

Q134: In 2014 the standard deduction for a