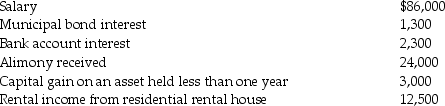

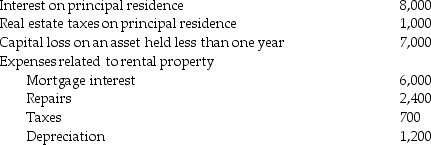

During the current year,Donna,a single taxpayer,reports the following items income of income and expenses:

Income:

Expenses/losses:

Expenses/losses:

Compute Donna's taxable income.(Show all calculations in good form.)

Compute Donna's taxable income.(Show all calculations in good form.)

Definitions:

Total Profit

The difference between a firm's total revenues and its total costs, representing the overall financial gain from its operations.

Lawn Mowing

The action of cutting the grass in an area or lawn to maintain its appearance and health, often performed as a domestic chore or commercial service.

Marginal Benefits

The supplementary gratification or value gained from using or making one more unit of a product or service.

Marginal Costs

The escalation in total expenses resulting from the manufacture of an additional product or service unit.

Q3: During the year Jason and Kristi,cash basis

Q16: Greg,a cash method of accounting taxpayer,owns 100

Q19: Erin,Sarah,and Timmy are equal partners in EST

Q23: Digger Corporation has $50,000 of current and

Q52: Tia receives a $15,000 cash distribution from

Q52: Parent Corporation purchases all of Target Corporation's

Q59: Medical expenses paid on behalf of an

Q71: Sarah had a $30,000 loss on Section

Q91: What basis do both the parent and

Q94: Mr.and Mrs.Gere,who are filing a joint return,have