Multiple Choice

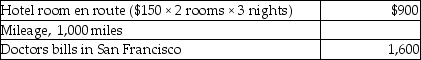

In 2014 Sela traveled from her home in Flagstaff to San Francisco to seek medical care.Because she was unable to travel alone,her mother accompanied her.Total expenses included:  The total medical expenses deductible before the 10% limitation are

The total medical expenses deductible before the 10% limitation are

Definitions:

Related Questions

Q23: Blair and Cannon Corporations are members of

Q40: Grand Corporation transfers 40% of its assets

Q55: All of the following are true of

Q58: Identify which of the following statements is

Q74: Sharif is planning to buy a new

Q74: Business investigation expenses incurred by a taxpayer

Q89: What are the two steps of a

Q95: Which one of the following is not

Q104: Alan,who is a security officer,is shot while

Q131: Joy purchased 200 shares of HiLo Mutual