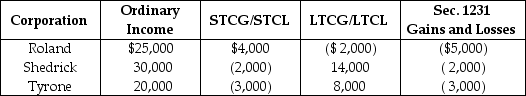

Roland,Shedrick,and Tyrone Corporations formed an affiliated group a number of years ago,which has since filed consolidated tax returns.No prior Sec 1231 losses have been reported by any group member.The group had a consolidated capital loss carryover last year.For the current year,the group reports the following results:  Which of following statements is incorrect?

Which of following statements is incorrect?

Definitions:

Q24: All C corporations can elect a tax

Q57: On January 2 of the current year,Calloway

Q62: If a partnership asset with a deferred

Q72: Electing large partnership rules differ from other

Q77: The amount of loss realized on the

Q77: If the FMV of the stock received

Q84: Parveen is married and files a joint

Q86: In July of 2014,Pat acquired a new

Q88: The MACRS system requires that residential real

Q127: West's adjusted gross income was $90,000.During the