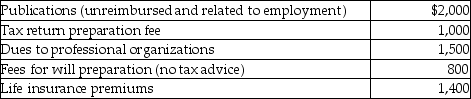

West's adjusted gross income was $90,000.During the current year he incurred and paid the following:  Assuming he can itemize deductions,how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

Assuming he can itemize deductions,how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

Definitions:

Empty Vessels

A metaphor often used to describe individuals or entities that lack content, knowledge, or ideas.

Stuart Hall

A prominent cultural theorist and sociologist known for his work on racial identity, media representation, and the encoding/decoding model of communication.

Beliefs, Values, Ideas

The foundational thoughts, principles, and ideologies that shape an individual's or society's worldview and behavior.

Stuart Hall

Stuart Hall was a cultural theorist and sociologist known for his pioneering work in critical theory, cultural studies, and the role of media in society.

Q13: Interest is not imputed on a gift

Q18: Buddy owns 100 of the outstanding shares

Q19: H (age 50)and W (age 48)are married

Q53: Interest expense incurred in the taxpayer's trade

Q54: If a taxpayer suffers a loss attributable

Q56: P and S are members of an

Q61: During the year 2014,a calendar year taxpayer,Marvelous

Q82: Mary and Martha,who had been friends for

Q84: Parveen is married and files a joint

Q102: During the current year,Jane spends approximately 90