Use the table for the question(s) below.

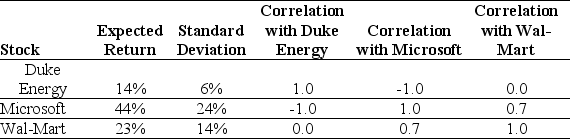

Consider the following expected returns,volatilities,and correlations:

-The expected return of a portfolio that is equally invested in Wal-Mart and Duke Energy is closest to:

Definitions:

Unit Tax

A tax that is imposed on a product based on a fixed amount per unit, rather than a percentage of the price.

Output

The cumulative quantity of products or services generated by a business, sector, or economic system over a given timeframe.

Profit

The financial gain achieved when the amount of revenue gained from a business activity exceeds the expenses, costs, and taxes needed to sustain it.

Demand Schedule

A table or graph showing the quantity of a product that consumers are willing and able to purchase at various prices during a specified period.

Q4: The weight of Ball Corporation in your

Q46: Which of the following statements regarding best

Q49: The following data represent selected information from

Q50: Your portfolio contains $33,000 of CP Rail

Q56: The under-investment problem refers to the problem

Q65: Which of the following is closest to

Q69: The expected return of a portfolio that

Q86: A low inventory turnover may indicate that

Q95: Stock issued in an IPO usually trades

Q107: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" A firm issues