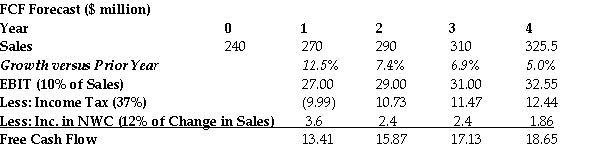

Use the table for the question(s) below.

-Banco Industries expect sales to grow at a rapid rate over the next 3 years, but settle to an industry growth rate of 5% in year 4. The spreadsheet above shows a simplified pro forma for Banco Industries. Banco Industries has a weighted average cost of capital of 12%, $50 million in cash, $60 million in debt, and 18 million shares outstanding. If Banco Industries can reduce their operating expenses so that EBIT becomes 12% of sales, by how much will their share price increase?

Definitions:

Factory Overhead

Indirect costs related to manufacturing, including costs associated with operating the factory like utilities and salaries, but excluding direct materials and direct labor.

Indirect Materials

Materials used in the production process that cannot be directly linked to specific products or jobs, such as lubricants for machinery.

Materials Requisitions

Requests or orders for company materials to be used in production, indicating types, amounts, and intended use.

Period Cost

Costs that are not directly tied to the production process and are expensed in the period in which they are incurred, such as selling, general, and administrative expenses.

Q9: If over the course of a year

Q11: A farmer sows a certain crop. It

Q16: Which of the following statements is FALSE?<br>A)The

Q39: Massive Inc shares have a market capitalisation

Q41: The table above shows the share prices

Q49: Suppose over the next year BHP has

Q66: Diversification reduces the risk of a portfolio

Q69: Luther Industries has outstanding tax loss carryforwards

Q84: How does IPO pricing puzzle financial economists?<br>_<br>_

Q93: An 7% APR with quarterly compounding is