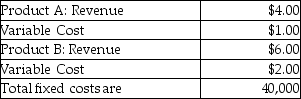

Use the information below to answer the following question(s) .The following information is for Winnie Company:

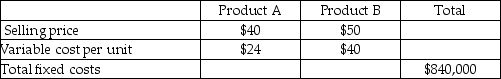

-Mount Carmel Company sells only two products, Product A and Product B.  Mount Carmel sells two units of Product A for each unit it sells of Product B.Mount Carmel faces a tax rate of 30%.Mount Carmel desires a net after-tax income of $73,500.The number of units needed to be sold to achieve the desired after-tax profit would be

Mount Carmel sells two units of Product A for each unit it sells of Product B.Mount Carmel faces a tax rate of 30%.Mount Carmel desires a net after-tax income of $73,500.The number of units needed to be sold to achieve the desired after-tax profit would be

Definitions:

Competition

The rivalry among businesses or entities to attract customers, increase sales, and achieve a dominant position in the market.

Knowledge Management

The process of capturing, distributing, and effectively using organizational knowledge to enhance performance, innovation, and competitive advantage.

Knowledge Dissemination

The process of spreading and sharing knowledge within an organization or to the broader public.

First-mover Strategy

A business strategy where a company is the first to enter a particular market or industry, gaining a competitive advantage.

Q1: Use the following information to determine which

Q10: What is the "operating income" assuming 250

Q25: Operating income is equal to net income

Q30: A cost accounting system should be revised

Q59: The first step in job costing is

Q65: Provide the missing data for the following

Q106: Target net income is computed by multiplying

Q111: A product is know as _ when

Q132: One of the benefits of an ABC

Q172: The general guideline for determining the minimum