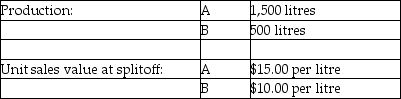

Use the information below to answer the following question(s) .Beverage Drink Company processes direct materials up to the splitoff point, where two products, A and B, are obtained.The following information was collected for the month of July:

Direct materials processed: 2,500 litres (with 20 percent shrinkage)

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

-All of the following statements about the constant gross margin percentage of net realizable method are true EXCEPT

Definitions:

Unemployment Taxes

Unemployment taxes are taxes paid by employers to fund the unemployment insurance system, providing benefits to workers who have lost their jobs.

FICA-OASDI

Federal Insurance Contributions Act - Old-Age, Survivors, and Disability Insurance; a payroll tax that funds Social Security and Medicare in the United States.

Workers' Compensation

Insurance offering medical benefits and wage replacement to employees who become injured while on the job.

Clerical Support

Administrative assistance typically involving office or paper work.

Q2: Activity-based costing has more applicability in a

Q13: Partial productivity equals quantity of output produced

Q21: Identify and explain Porter's Five Forces model.

Q27: If a dual-rate cost allocation method is

Q51: What is the direct manufacturing labour partial

Q53: Different joint cost allocation methods will result

Q92: Using the sales value at splitoff method,

Q93: What is the Luke Company's revenue effect

Q124: What is the unit cost for February

Q137: Employee satisfaction is a measure of the