Answer the following question(s) using the information below:

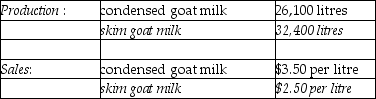

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result.The following information was collected for the month of October:

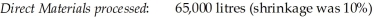

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

-Using estimated net realizable value, what amount of the $72,240 of joint costs would be allocated Xyla and the skim goat ice cream?

Definitions:

Resolving Conflicts

The process of identifying and addressing differences that impede the achievement of goals.

Task-related Conflicts

Disagreements or disputes that arise over how a particular job or task should be done, its goals, and the resources allocated to it.

Change Competency

The ability of individuals or organizations to adapt effectively to new conditions, transformations, or innovations.

Implement Needed Adaptations

The process of making necessary changes or adjustments to procedures, policies, or strategies to meet new conditions.

Q22: What is the estimated net realizable value

Q23: Fresh Bread Company sells a special mix

Q60: The use of budget capacity in the

Q67: What is the STP total sales-volume variance

Q91: Long-run pricing is a strategic decision designed

Q92: AAA Fence Company manufactures wireless and aluminium

Q107: In rate regulation settings, which method is

Q129: The costs of designing and implementing sophisticated

Q144: The first-in, first-out process-costing method computes unit

Q145: The target profit percentage for setting prices