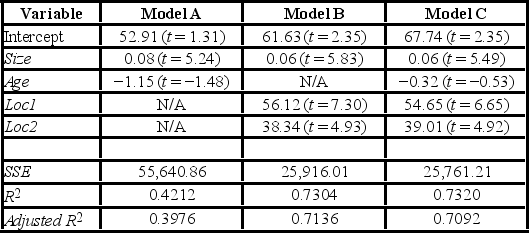

A realtor wants to predict and compare the prices of homes in three neighboring locations. She considers the following linear models:

Model A: Price = β0 + β1 Size + β2 Age + ε

Model B: Price = β0 + β1 Size + β3 Loc1 + β4 Loc2 + ε

Model C: Price = β0 + β1 Size + β2 Age + β3 Loc1 + β4 Loc2 + ε

where,

Price = the price of a home (in $1,000s)

Size = the square footage (in sq. feet)

Loc1 = a dummy variable taking on 1 for Location 1, and 0 otherwise

Loc2 = a dummy variable taking on 1 for Location 2, and 0 otherwise

After collecting data on 52 sales and applying regression, her findings were summarized in the following table.  Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Using Model C, what is the conclusion for testing the joint significance of the two dummy variables at the 1% significance level?

Definitions:

Quality-Enhanced

A description for improvements made to a product or service to increase its value or appeal to consumers.

Reported Earnings

The profit a company officially reports to the public in its financial statements, adhering to standard accounting practices.

Current Earnings

The amount of profit a company has generated during a specific period, often before the deduction of taxes and other expenses.

Stock Prices

The current market price of a company's share, reflecting what investors are willing to pay for it at a given time.

Q15: When comparing polynomial trend models, we use

Q44: Rita Jacob purchased a corporate bond at

Q54: Holding all else constant, call options with

Q68: Quarterly sales of a department store for

Q73: The following scatterplot shows productivity and number

Q80: When an option is exercised the time

Q107: Pearson's correlation coefficient is used as the

Q117: Consider the following regression results based on

Q120: When Dana Roberts started her job as

Q139: Another name for an explanatory variable is