Use the following information to answer the question(s) below..

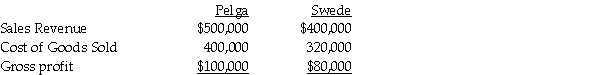

Pelga Company routinely receives goods from its 80%-owned subsidiary,Swede Corporation.In 2014,Swede sold merchandise that cost $80,000 to Pelga for $100,000.Half of this merchandise remained in Pelga's December 31,2014 inventory.This inventory was sold in 2015.During 2015,Swede sold merchandise that cost $160,000 to Pelga for $200,000.$62,500 of the 2015 merchandise inventory remained in Pelga's December 31,2015 inventory.Selected income statement information for the two affiliates for the year 2015 was as follows:

-Shalles Corporation,a 80%-owned subsidiary of Pani Corporation,sold inventory items to its parent at a $48,000 profit in 2014.Pani resold one-third of this inventory to outside entities.Shalles reported net income of $200,000 for 2014.Noncontrolling interest share of consolidated net income that will appear in the income statement for 2014 is

Definitions:

Percent Change

A mathematical calculation that shows how much a quantity has increased or decreased as a percentage of its previous value.

Trial Balance

A bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account columns to check the accuracy of financial transactions.

Transaction Posted

The act of recording a financial transaction in the accounting records of a company.

Debit

A ledger entry contributing to the growth of assets or lessening of liabilities in a company's financial statement.

Q1: Prepare journal entries to record the following

Q8: Will Wealth made three charitable donations in

Q8: Pelican Corporation acquired a 25% interest in

Q16: A donor gives a Voluntary Health and

Q20: In the Uniform Partnership Act,partners have<br>I.mutual agency.<br>II.unlimited

Q25: Parrot Company owns all the outstanding voting

Q36: The balance sheet of the Park,Quid,and Reggie

Q39: The book value of the partnership equity

Q111: The record of a country's transactions in

Q146: The real exchange rate of Japanese yen