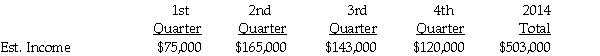

Nettle Corporation is preparing its first quarterly interim report.It is subject to a corporate income tax rate of 20% on the first $50,000 of taxable income and 35% on taxable income above $50,000.Its estimated pretax accounting income for 2014,by quarter,is:

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1.Determine Nettle's estimated effective tax rate for 2014.

2.Prepare a schedule to show Nettle's estimated net income for each quarter of 2014.

Definitions:

Dominant

A trait or gene that is expressed in the phenotype even when only one copy is present, overshadowing the recessive trait.

Heterozygous

A genetic condition where an individual has two different alleles for a specific gene.

Alleles

Alternative forms of a gene that occur at a specific locus on a chromosome, contributing to genetic diversity.

Gene

A unit of hereditary information composed of DNA, which resides on chromosomes and influences specific characteristics.

Q3: Cindy Lou's parents passed away while she

Q4: Swamp Co. ,a 55%-owned subsidiary of Pond

Q4: Anna and Bess share partnership profits and

Q6: If the partnership experiences a net loss

Q11: Krull Corporation is preparing its interim financial

Q15: Anthony and Cleopatra create a joint venture

Q20: In order to lift a bucket of

Q28: The following are transactions for the city

Q34: Pretax operating incomes of Panitz Corporation and

Q43: A 615 N student standing on a