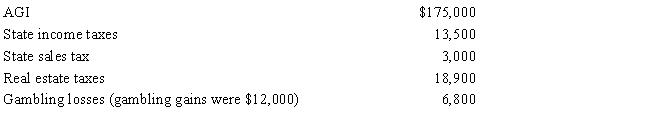

Paul, a calendar year married taxpayer, files a joint return for 2017. Information for 2017 includes the following: Paul's allowable itemized deductions for 2017 are:

Definitions:

Warranty

A warranty is a guarantee provided by a seller to a buyer, promising to repair or replace a product if it fails within a certain period after purchase.

Disclaimed

The act of renouncing a claim to or denying responsibility for something, often seen in legal disclaimers or warranties.

Type

A category or class that individuals or things can be grouped into based on shared characteristics or qualities.

Implied Warranty

A legal term for the unspoken and unwritten guarantees that the law assumes goods or services must meet.

Q5: Julie, who is single, has the following

Q30: The excess of nonbusiness capital gains over

Q46: Eula owns a mineral property that had

Q48: Treatment of a sale of a passive

Q71: The § 222 deduction for tuition and

Q84: Darin, who is age 30, records itemized

Q88: A worker may prefer to be classified

Q99: Vail owns interests in a beauty salon,

Q107: Roger is considering making a $6,000 investment

Q165: Meg teaches the fifth grade at a