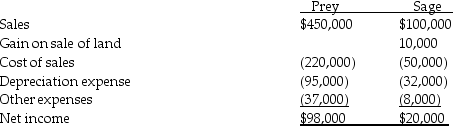

Prey Corporation created a wholly owned subsidiary,Sage Corporation,on January 1,2013,at which time Prey sold land with a book value of $90,000 to Sage at its fair market value of $140,000.Also,on January 1,2013,Prey sold to Sage equipment with a book value of $130,000 and a selling price of $165,000.The equipment had a remaining useful life of 4 years and is being depreciated under the straight-line method.The equipment has no salvage value.On January 1,2015,Sage resold the land to an outside entity for $150,000.Sage continues to use the equipment purchased from Prey.Income statements for Prey and Sage for the year ended December 31,2015 are summarized below:

Required:

Required:

At what amounts did the following items appear on the consolidated income statement for Prey and Subsidiary for the year ended December 31,2015?

1.Gain on Sale of Land

2.Depreciation Expense

3.Consolidated net income

4.Controlling interest share of consolidated net income

Definitions:

Hyponatremia

A condition where there is an abnormally low level of sodium in the blood.

Sodium Diet

A dietary plan focusing on the reduction or control of sodium intake, often recommended to manage or prevent hypertension.

Fluid Restriction

A medical instruction to limit the amount of fluid intake, usually due to certain health conditions.

Heart Failure

A condition in which the heart is unable to pump sufficiently to maintain blood flow to meet the body's needs.

Q1: 19-13.In an equity participation loan the lender

Q1: The primary institutional investors in equity real

Q1: Consolidation procedures for direct and indirect holdings

Q6: Investors purchase multiple properties to:<br>A) diversify a

Q8: Pallet Corporation owns 80% of Adelt Corporation

Q13: If a parent company and outside investors

Q15: What is the amount of total assets?<br>A)$1,380,000<br>B)$1,402,000<br>C)$1,470,000<br>D)$1,875,000

Q20: On January 2,2013 Palta Company issued 80,000

Q32: Piel Corporation (a U.S.company)began operations on January

Q39: Olson Corporation paid $62,000 to acquire 100%