Use the following information to answer the question(s) below.

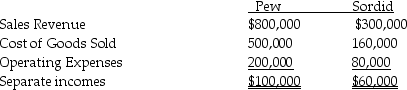

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

-The 2014 consolidated income statement showed cost of goods sold of

Definitions:

Q6: Pfeifer Corporation acquired an 80% interest in

Q6: Net income of an investee with preferred

Q7: The seller-lessee cannot account for the transaction

Q8: Pallet Corporation owns 80% of Adelt Corporation

Q25: 11-18.If the value of the IO strip

Q25: Paster Corporation was seeking to expand its

Q29: For the year ending December 31,2014,the amount

Q38: On November 1,2014,Ross Corporation,a calendar-year U.S.corporation,invested in

Q41: According to ASC 805-30,which one of the

Q45: Behd Company,a U.S.firm,sold some of its inventory