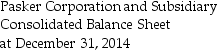

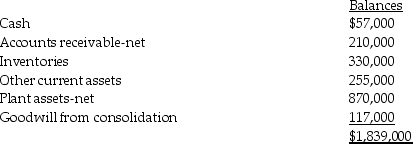

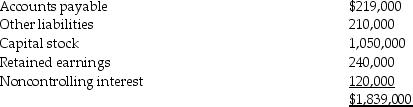

The consolidated balance sheet of Pasker Corporation and Shishobee Farm,its 80% owned subsidiary,as of December 31,2014,contains the following accounts and balances:

Pasker Corporation acquired its interest in Shishobee Farm on January 1,2014,when Shishobee Farm had $450,000 of Capital Stock and $210,000 of Retained Earnings.Shishobee Farm's net assets had fair values equal to their book values when Pasker acquired its interest.No changes have occurred in the amount of outstanding stock since the date of the business combination.Pasker uses the equity method of accounting for its investment.

Pasker Corporation acquired its interest in Shishobee Farm on January 1,2014,when Shishobee Farm had $450,000 of Capital Stock and $210,000 of Retained Earnings.Shishobee Farm's net assets had fair values equal to their book values when Pasker acquired its interest.No changes have occurred in the amount of outstanding stock since the date of the business combination.Pasker uses the equity method of accounting for its investment.

Required: Determine the following amounts:

1.The balance of Pasker's Capital Stock and Retained Earnings accounts at December 31,2014.

2.Cost of Pasker's purchase of Shishobee Farm on January 1,2014.

Definitions:

Competitive Position

Describes a company's standing and strategy in comparison to its competitors within the industry.

Merger Analysis

Merger analysis involves evaluating the financial and operational impacts of combining two or more companies into a single entity.

Capital Budgeting

The process of evaluating and selecting long-term investments that are aligned with the firm's goal of shareholder wealth maximization.

Terminal Value Estimates

Calculations used to predict the future value of an investment or company beyond the forecast period, often considered in discounted cash flow analyses.

Q1: A review of Ace Industries,a U.S.corporation,shows the

Q2: The parent affiliate recognizes a gain on

Q2: 11-23.A security for which the cash flows

Q5: A subsidiary can be excluded from consolidation

Q12: In the consolidated income statement of Wattlebird

Q12: On January 2,2013 Carolina Clothing issued 100,000

Q17: Parakeet Company has the following information collected

Q30: 10-19.Mortgage-related securities that promise payments similar to

Q36: 18-12.In the event of a default,the development

Q36: No constructive gain or loss arises from