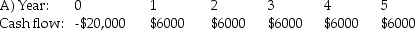

The cash flows for four projects are shown below, along with the cost of capital for these projects. If these projects are mutually exclusive, which one should be taken?  Cost of Capital: 8.2%

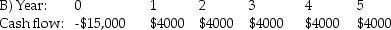

Cost of Capital: 8.2% Cost of Capital: 7.0%

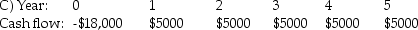

Cost of Capital: 7.0% Cost of Capital: 7.6%

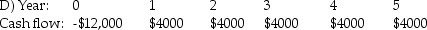

Cost of Capital: 7.6% Cost of Capital: 5.0%

Cost of Capital: 5.0%

Definitions:

Monopolistic Competition

A market structure where many companies sell products that are similar but not identical, leading to competition based on price, quality, and branding.

Normal Profit

The minimum level of profit needed for a company to remain competitive in the market, essentially covering opportunity costs.

Nonprice Competition

Strategies used by companies to attract customers through methods other than lowering prices, such as quality improvement, service, or branding.

Product Differentiation

The practice of individualizing a product or service in the marketplace to make it more enticing to a targeted audience.

Q4: Joe borrows $100,000 and agrees to repay

Q18: What is the yield to maturity of

Q19: What is one of the prerequisite conditions

Q50: Assuming that your capital is constrained, which

Q69: Divisional costs of capital are more appropriate

Q81: What is the most important function of

Q85: A car dealership offers a car for

Q91: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" The above table

Q92: A security company offers to provide CCTV

Q103: Which of the following statements is FALSE?<br>A)