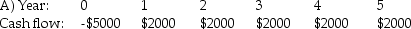

The cash flows for four projects are shown below, along with the cost of capital for these projects. If these projects are mutually exclusive, which one should be taken?  Cost of Capital: 6.0%

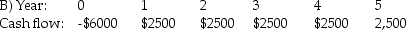

Cost of Capital: 6.0% Cost of Capital: 7.5%

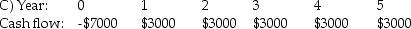

Cost of Capital: 7.5% Cost of Capital: 7.5%

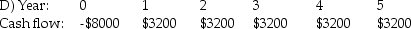

Cost of Capital: 7.5% Cost of Capital: 9.2%

Cost of Capital: 9.2%

Definitions:

Oxygen

A chemical element with symbol O and atomic number 8, essential for most life forms on Earth as a critical component of the air we breathe.

Carbon Dioxide

A colorless, odorless gas produced by burning carbon and organic compounds and by respiration. It is naturally present in air and is absorbed by plants in photosynthesis.

Largest Cartilage

The thyroid cartilage, better known as the Adam’s apple, is the largest cartilage in the larynx or voice box.

Larynx

The voice box located in the throat, responsible for producing sound, protecting the airway during swallowing, and regulating airflow.

Q1: Which of the following situations is best

Q2: Stocks have both diversifiable risk and undiversifiable

Q5: A corporate bond which receives a BBB

Q17: Treasury bill returns are 4%, 3%, 2%,

Q23: Gonzales Corporation generated free cash flow of

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" Consolidated Insurance wants

Q37: Aerelon Airways, a commercial airline, suffers a

Q44: If the current rate of interest is

Q46: Several methods should be used to provide

Q71: The capital budgeting process begins by _.<br>A)