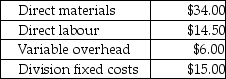

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

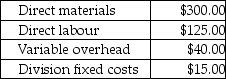

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-What is the market-based transfer price per compressor from the Compressor Division to the Assembly Division?

Definitions:

Cash Burn

The rate at which a company spends its cash reserves before generating positive cash flow.

Cash Equivalents

Highly liquid investments that are readily convertible to known amounts of cash and have an original maturity of three months or less.

Monthly Cash Expenses

The total amount of money spent by an individual or business in cash over the course of a month.

Compensating Balance

A minimum balance that a borrower must maintain in a bank account as a condition for getting a loan from that bank.

Q3: Assume the transfer price for a pair

Q31: What is EVA for Ottawa?<br>A) $218,200<br>B) $42,600<br>C)

Q33: The Micro Division of Silicon Computers produces

Q39: Which of the following incorporates the amount

Q47: For the period just ended, Trident Ltd.

Q100: Which of the following is not a

Q106: The disposal of a machine (or any

Q109: Purchasing costs consist of the costs of

Q109: A transfer pricing method should lead to

Q118: The payback method allows for managers to