Answer the following question(s) using the information below:

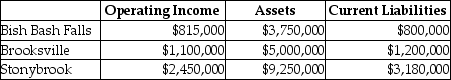

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million) . Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Stonybrook?

Definitions:

Signal

An act, gesture, or piece of information that conveys a message, intention, or desired action to another party.

Predict

To foretell or estimate the likelihood of a future event or trend based on current knowledge or analysis.

Encoding

The process of converting information into a form that can be communicated or processed.

Symbolic Form

The representation of ideas, principles, or phenomena through symbols rather than explicit or direct forms.

Q1: All of the following are appropriate methods

Q6: Ocelot Corporation is merging into Tiger Corporation

Q14: If the Assembly Division sells 1,000 air

Q21: All of the following statements are true

Q47: Present Value Tables needed for this question.

Q48: Britta, Inc., a U.S. corporation, reports foreign-source

Q80: Chaucer Ltd. has current assets of $450,000

Q97: What is the EVA for Stonybrook?<br>A) $1,108,000<br>B)

Q113: A present value analysis is beneficial when

Q122: Backflush costing is an example of sequential