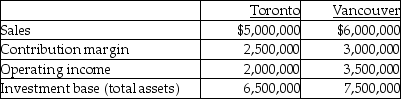

Use the information below to answer the following question(s) .Berger Publishing has two divisions which operate autonomously.Their results for the past year were as follows:

The company's desired rate of return is 15%.

The company's desired rate of return is 15%.

-What are the respective residual incomes for the Toronto and Vancouver divisions?

Definitions:

Subsidiary's Equipment

Assets like machinery and tools owned by a subsidiary, which is a company controlled by another parent company.

Consolidation

The process of combining the financial statements of a parent company with those of its subsidiaries, presenting the financial results as if the group of companies was a single entity.

Long-Term Debt

Borrowings and other financial obligations that are due for repayment beyond the next 12 months, usually including bonds, loans, and lease obligations.

Q57: A tax avoidance motive is essential in

Q63: During the past year Badger Company had

Q65: In the year that the group terminates

Q87: What is the Refining Division's operating income

Q98: Saturn Ltd. wants to automate one of

Q105: ParentCo, SubOne and SubTwo have filed consolidated

Q106: The net present value method is a

Q115: What is the annual expense deduction for

Q120: The degree of freedom to make decisions

Q153: "Inbound" and "offshore" transfers are exempt from