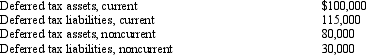

After applying the balance sheet method to determine the GAAP income tax expense of Cutter Inc., the following account balances are found. Determine the balance sheet presentation of these amounts. Hint: Which of the accounts should you combine for the final balance sheet disclosure?

Definitions:

Instrument

A formal document, especially one that legally records a fact, act, or agreement.

Enforceable Contract

A legally binding agreement that can be upheld and compelled in a court of law.

Negotiability

The quality of a financial instrument that allows it to be transferred from one party to another with minimal legal restrictions.

Sum Certain

A specified, fixed amount of money that is agreed upon in a financial or legal document, leaving no ambiguity regarding the amount.

Q16: Josh has a 25% capital and profits

Q51: Clipp, Inc., earns book net income before

Q59: With respect to special allocations, is the

Q67: A $50,000 cash tax savings that is

Q89: Henry contributes property valued at $60,000 (basis

Q93: City, Inc., an exempt organization, has included

Q95: Albert and Bonnie each own 50% of

Q113: A state sales tax usually falls upon:<br>A)

Q134: A business entity is not always taxed

Q149: Discuss any negative tax consequences that result