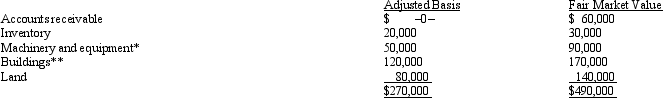

Mr. and Ms. Smith's partnership owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Stimulants

Substances that increase activity in the brain and nervous system, leading to increased alertness and physical activity.

Psychoactive Drugs

Substances that, when taken, alter perception, mood, consciousness, cognition, or behavior by affecting the central nervous system.

Brain Neurotransmitters

Chemical messengers in the brain that transmit signals across synapses from one neuron to another, influencing mental function and emotional state.

Problem-Focused Theory

A theory that emphasizes solving specific problems as a way to address and manage stress or psychological issues.

Q9: Molly is a 40% partner in the

Q31: An intermediate sanction imposed by the IRS

Q32: Beth sells her 25% partnership interest to

Q35: In a proportionate liquidating distribution in which

Q42: Albert's sole proprietorship owns the following assets:

Q54: Beginning in 2011, the AAA of Ewing,

Q72: Simpkin Corporation owns manufacturing facilities in States

Q108: Identify some state/local income tax issues facing

Q125: On December 31, 2010, Erica Sumners owns

Q140: Circular 230 requires that the tax practitioner