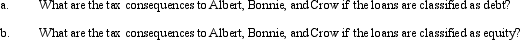

Albert and Bonnie each own 50% of the stock of Crow, Inc. (a C corporation). To cover what is perceived as temporary working capital needs, each shareholder loans Crow $150,000 with an annual interest rate of 5% (same as the Federal rate) and a maturity date of one year. The loan is made at the beginning of 2011.

Definitions:

Residual Income

The amount of income that an individual or company retains after all operating expenses and charges, including cost of capital, have been deducted.

Minimum Required Rate

The lowest acceptable rate of return on an investment that a manager or investor specifies, considering the project's risk level.

Investment Opportunity

A financial investment or venture with the potential for yielding returns, involving the allocation of resources with the expectation of future financial gains.

Return On Investment

A measurement of the profitability of an investment, calculated by dividing net profit by the initial capital cost.

Q2: One can describe the benefits of ASC

Q27: Which of the following are exempt organizations

Q29: Ralph owns all the stock of Silver,

Q46: A cash basis calendar year C corporation

Q47: S corporations must withhold taxes on the

Q53: Which of the following are organizations exempt

Q92: The JPM Partnership is a US-based manufacturing

Q102: Describe how an exempt organization can be

Q139: Which statement is incorrect with respect to

Q153: Shaker Corporation operates in two states, as