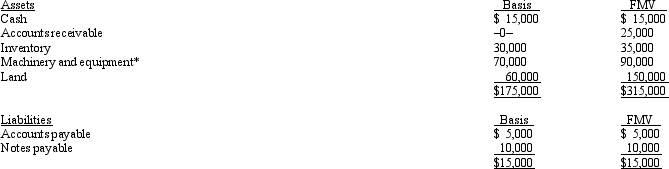

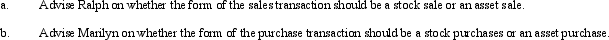

Ralph owns all the stock of Silver, Inc., a C corporation for which his adjusted basis is $225,000. Ralph founded Silver 12 years ago. The assets and liabilities of Silver are as follows:

*Accumulated depreciation of $55,000 has been deducted.

*Accumulated depreciation of $55,000 has been deducted.

Ralph and the purchaser, Marilyn, have agreed to a purchase price of $350,000 less any outstanding liabilities. They are both in the 35% tax bracket, and Silver is in the 34% tax bracket.

Definitions:

Negligent

Failing to exercise the care that a reasonably prudent person would exercise in similar circumstances, often leading to harm or injury.

Working Papers

Documents that record the audit processes, evidence, and findings, used by auditors to support their analysis and conclusions.

Financial Reports

Documents that provide an overview of a company's financial condition, including income statements, balance sheets, and cash flow statements.

Owned By

The state or condition of being legally possessed or controlled by an individual or entity.

Q11: Alice contributes equipment (fair market value of

Q37: Wailes Corporation is subject to a corporate

Q48: A limited liability company generally provides limited

Q50: In a proportionate liquidating distribution, RST Partnership

Q54: Which citation refers to a Third Circuit

Q63: If the partnership properly makes an election

Q81: Barb and Chuck each have a 50%

Q89: Individuals Adam and Bonnie form an S

Q137: If an S corporation has C corporate

Q153: Shaker Corporation operates in two states, as